E-Scooter Insurance Dubai: Do You Actually Need It? (2026 Reality)

Here’s what nobody tells you until it’s too late: e-scooter insurance in Dubai doesn’t really exist.

Not in the way car insurance exists. Not in the way you think.

And if you hit someone—or something expensive—you’re paying out of pocket. Personally. No insurance company between you and a very angry Land Cruiser owner demanding 15,000 AED for a dented bumper.

Yallah, let’s talk about what actually happens when the worst happens.

The Short Answer: No, You Don’t Need Insurance (Because It Doesn’t Exist)

As of January 2026, the UAE does not require private e-scooter owners to carry insurance.

Unlike Spain and several EU countries that just implemented mandatory e-scooter insurance this month, Dubai has no such law. You can buy a 3,000 AED scooter, ride it tomorrow, and nobody will ask for proof of insurance.

Sounds convenient, right?

Until you realize what “no insurance requirement” actually means: you are personally liable for every single dirham of damage you cause.

If you’re riding in JBR and accidentally clip a parked Porsche Cayenne:

- The car owner’s comprehensive insurance will fix their car

- The insurance company will then sue YOU to recover costs

- You pay. Out of pocket. No insurance to hide behind.

A minor scrape on a luxury SUV? Easily 8,000-15,000 AED. A cracked bumper with sensors? 25,000+ AED.

But Wait—Rental Scooters ARE Insured

Here’s what most riders don’t realize: when you rent from Lime, Tier, or Arnab, a portion of that 3 AED unlock fee and 0.80 AED per minute goes toward Third-Party Liability (TPL) insurance.

The rental operators carry liability coverage. If you hit someone while riding their scooter, their insurance handles it (up to policy limits).

- Rental scooters (Lime/Tier/Arnab): Covered by operator’s TPL insurance

- Your personal scooter: Zero coverage unless you arrange it yourself

This is why rental scooters cost more than you’d expect—you’re paying for that insurance whether you realize it or not.

The High-Performance Scooter Trap

Now here’s where it gets messy.

If you bought one of those “beast” scooters—Dualtron, VSETT, anything that hits 40+ km/h—police are increasingly flagging these as “e-mopeds” instead of e-scooters.

And e-mopeds? Those DO require registration and insurance. Just like motorcycles.

Police have confiscated thousands of high-powered scooters in 2024-2025 because:

- They exceed 25-30 km/h (e-scooter legal limit)

- They look like mopeds or small motorcycles

- Riders don’t have registration or insurance

If you’re riding a 5,000+ AED performance scooter without papers, you’re gambling. Confiscation means paying all fines PLUS a 3,000 AED release fee—or just abandoning it and buying a new one.

The 2024 Numbers: Why This Matters

Let’s talk about what actually happened in Dubai last year.

Dubai E-Scooter & E-Bike Incidents (2024 Full Year)

That’s roughly 43 violations per day involving e-scooters or bicycles.

Ten deaths. Two hundred fifty-nine injuries. Twenty-six thousand confiscations.

And in most of those incidents, riders had zero insurance. The financial consequences? All personal liability.

What Happens When You Cause an Accident

The Dubai Police report decides everything.

If the police determine you’re at fault—riding in a prohibited zone, jumping a red light, hitting a pedestrian—here’s what happens:

Scenario 1: You Hit a Parked Car

- Step 1: Car owner’s comprehensive insurance fixes their car

- Step 2: Insurance company reviews police report, sees you’re at fault

- Step 3: Insurance company sues you to recover repair costs

- Step 4: You pay (because you have no insurance to deflect this)

If the car owner only has third-party insurance? They can’t claim from their own insurer. They sue you directly. You pay.

Scenario 2: You Hit a Pedestrian

This is worse.

Medical bills in Dubai private hospitals run 1,500-3,000 AED per ER visit. A broken bone requiring surgery? 15,000-30,000 AED. Serious injuries requiring weeks of treatment? 100,000+ AED.

You’re liable for all of it if the police report says you’re at fault.

Under UAE law, if you cause death or permanent disability, compensation can reach 200,000 AED or more.

You have no insurance. You pay personally. The court will garnish your salary if you can’t pay upfront.

Scenario 3: A Car Hits You

Now here’s the one scenario where you’re somewhat protected:

If a car hits you and the police determine the driver is at fault, their motor insurance covers:

- Your medical bills

- Your scooter repair/replacement

- Compensation for injuries

Every UAE car insurance policy includes third-party liability cover. You don’t need your own insurance to claim against theirs.

But if YOU’RE at fault—riding where you shouldn’t, running a red light, riding against traffic—you get nothing. And you still pay for any damage you caused to their car.

The “Workarounds” That Actually Work

So what do you actually do?

Since dedicated e-scooter insurance doesn’t exist in Dubai, here are the options people actually use:

Option 1: Personal Accident Insurance (Best Option)

This is the closest thing to real protection you’ll find.

Cost: 150-300 AED/year

Covers:

- Your own medical bills if you fall or crash

- Hospitalization costs

- Disability compensation

- Death benefits for your family

Does NOT cover: Damage you cause to others or their property

Available from most UAE insurers (Sukoon, AXA, MetLife, etc.). You can buy it standalone online in 10 minutes.

It won’t protect you if you hit someone else’s car, but it covers YOUR injuries—which is more than most riders have.

Option 2: Home Insurance Extensions (Theft Only)

Some UAE home insurance policies (Sukoon, L’azurde, Dubai Insurance) allow you to add “Personal Possessions” or “Sports Equipment” coverage.

What it covers: Theft of your scooter (if stolen from your home or car)

What it doesn’t cover: Liability if you hit someone/something

Cost: Usually adds 50-100 AED to your annual home insurance premium

Better than nothing if you own an expensive scooter, but it won’t help you if you cause an accident.

Option 3: Travel Insurance (Tourists Only)

If you’re visiting Dubai and renting a scooter, check your travel insurance policy.

Some comprehensive travel insurance includes coverage for “light motorized vehicles” or “recreational activities.” Read the fine print—many exclude vehicles over 50cc or faster than 25 km/h.

Option 4: General Liability Insurance (Overkill for Most)

Businesses can purchase general public liability insurance that covers accidents caused while using equipment.

Cost: 1,000-3,000 AED/year depending on coverage limits.

Only makes sense if you’re using your scooter for business (delivery riders, couriers) or if you regularly ride in high-risk areas.

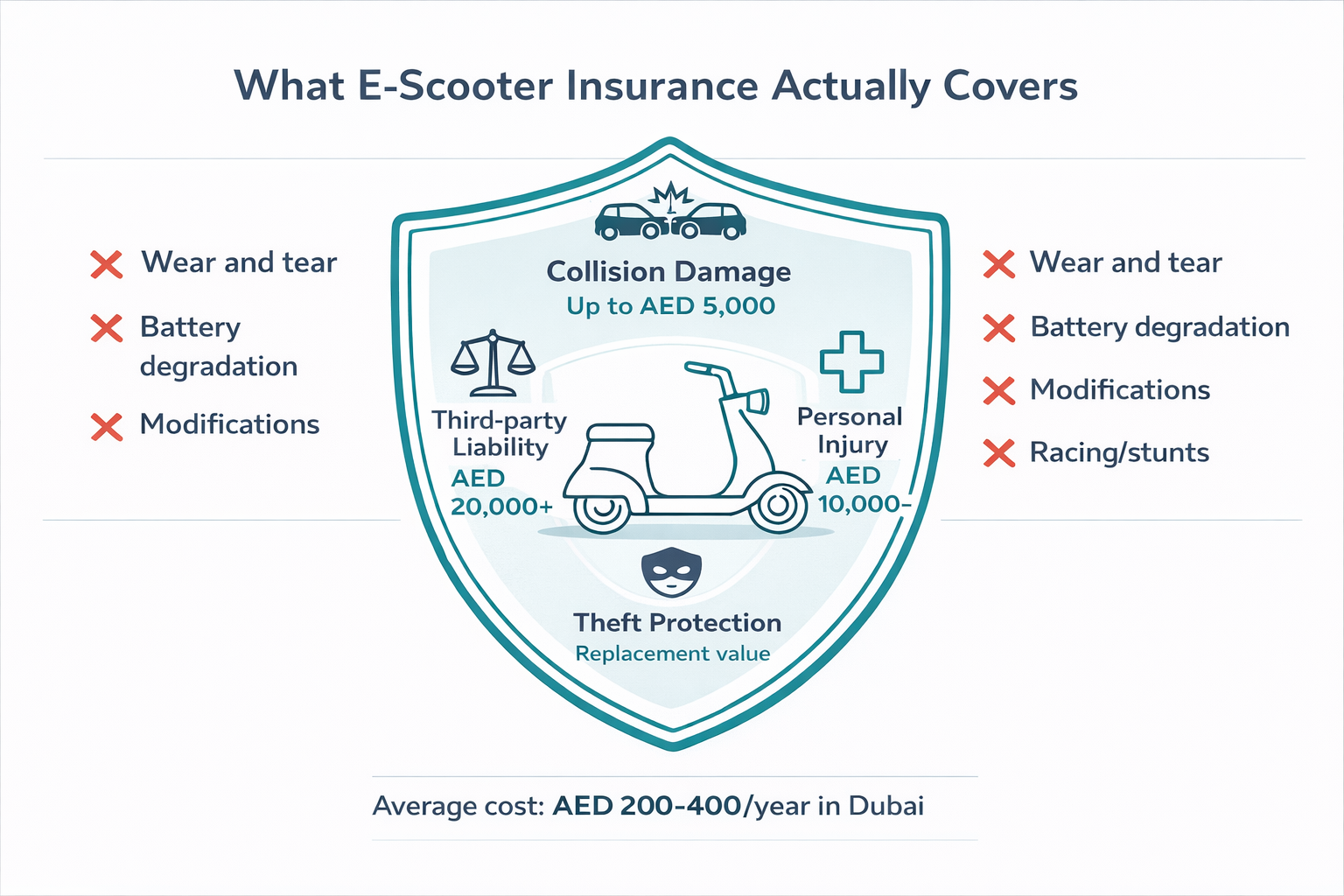

The Insurance Gap: What Nobody’s Covering

Here’s the brutal truth about what’s NOT covered by any option above:

✗ What You CANNOT Insure

- Damage you cause to other vehicles

- Injury you cause to pedestrians

- Property damage (breaking someone’s fence, damaging a building)

- Legal costs if someone sues you

✓ What You CAN Insure

- Your own injuries (personal accident insurance)

- Your scooter theft (home insurance extension)

- Your medical bills (health insurance might cover)

That massive gap in the middle—third-party liability—is where people get financially destroyed.

When You’re at Fault: The Real Costs

Let’s put numbers to this. Here’s what you’d pay out of pocket if you cause various accidents:

| Incident Type | Typical Cost Range |

|---|---|

| Minor car scratch/dent | 2,000 – 5,000 AED |

| Cracked bumper (luxury car with sensors) | 15,000 – 30,000 AED |

| Pedestrian injury (minor – ER visit) | 3,000 – 8,000 AED |

| Pedestrian injury (broken bone + surgery) | 20,000 – 50,000 AED |

| Serious injury (long-term treatment) | 100,000 – 200,000 AED |

| Legal fees if sued | 5,000 – 15,000 AED |

No insurance company in the UAE will cover these costs for you. You pay.

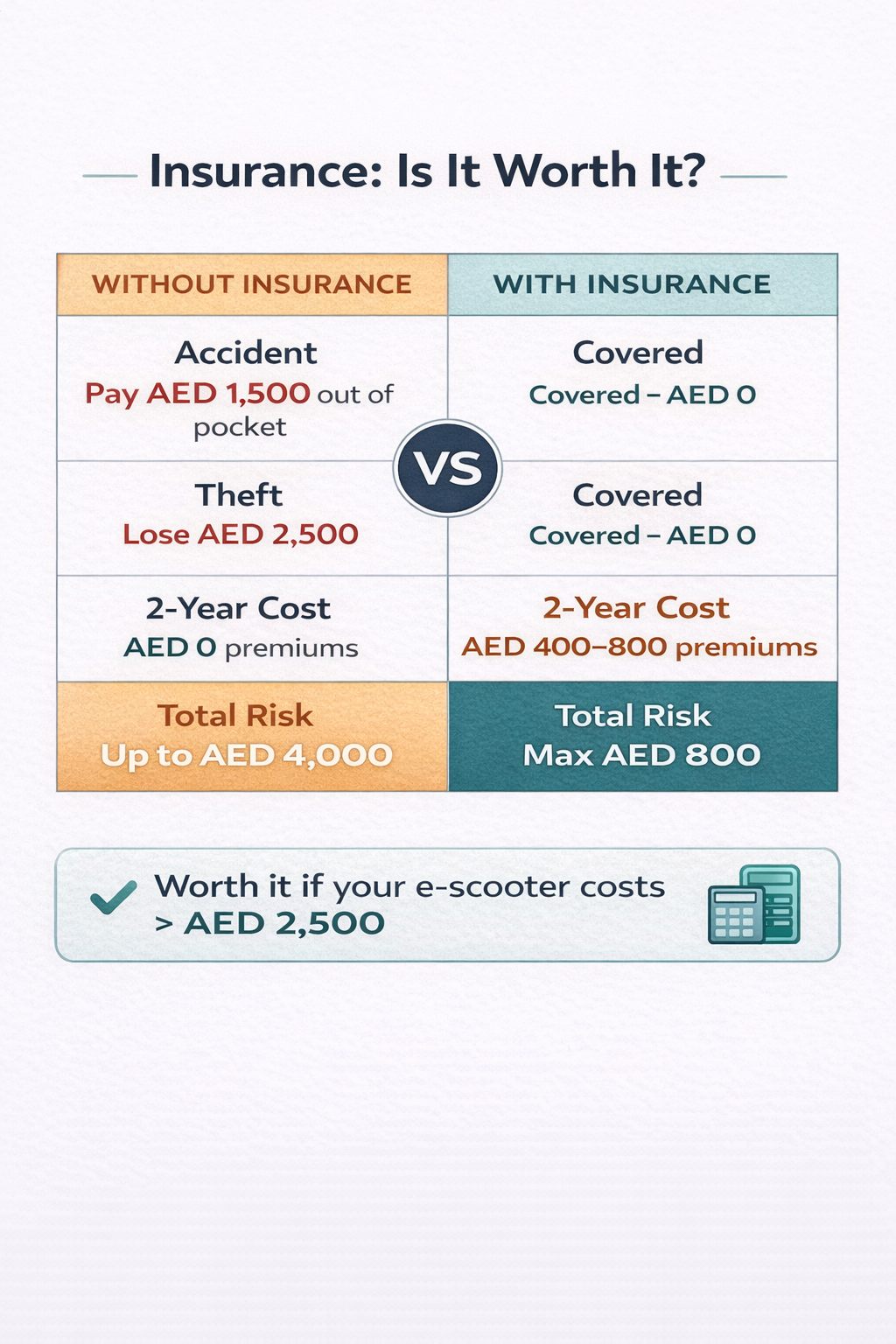

What Should You Actually Do?

Given the reality that real insurance doesn’t exist, here’s the practical approach:

- Buy personal accident insurance (150-300 AED/year) to cover your own injuries

- Add scooter to home insurance (if you own an expensive model) for theft protection

- Ride defensively as if you have no insurance (because you don’t)

- Stay in legal zones to reduce liability risk if police report assigns fault

- Keep emergency fund of 10,000-20,000 AED for worst-case accident scenarios

If You’re a Delivery Rider

If you’re doing Talabat, Deliveroo, Noon deliveries on your scooter, you need more than personal accident insurance.

Consider:

- General liability insurance (1,000-3,000 AED/year)

- Checking if your employer’s commercial insurance extends to you

- Setting aside 20-30% of earnings in an emergency fund for liability claims

The company you deliver for won’t cover you if you hit someone. You’re an independent contractor. You pay.

If You Own a High-Performance Scooter

If your scooter can hit 40+ km/h:

Police are cracking down on performance scooters in 2026. Options:

- Option 1: Get motorcycle registration/insurance (if your model qualifies)

- Option 2: Only ride in private communities where RTA doesn’t patrol

- Option 3: Accept confiscation risk and budget for the 3,000 AED release fee

The Honest Summary

E-scooter insurance in Dubai is a mess.

There’s no mandatory requirement. There’s no real product designed for private scooter owners. There’s just a bunch of workarounds that cover pieces of the risk but never the whole thing.

The biggest gap—third-party liability—is completely uninsurable unless you’re willing to buy expensive general liability insurance meant for businesses.

You ride an e-scooter in Dubai at your own financial risk.

If you cause a serious accident, you could be personally liable for 50,000-200,000 AED with no insurance to cover it.

The police report decides fault. If you’re at fault, you pay. Every dirham. Out of pocket.

Some people are okay with that risk. They ride carefully, stick to legal zones, and hope nothing bad happens.

Some people buy personal accident insurance for 200 AED/year and call it good enough.

Some people decide it’s not worth the risk and stick to rental scooters (which ARE insured) or just use Metro + Careem.

The choice is yours. But at least now you know what you’re choosing.

Insurance or not, the best protection is not needing it:

- Ride in legal zones only

- Stay under 20 km/h speed limit

- Assume every car doesn’t see you

- Don’t ride like you’re insured (because you’re not)